If you’re a property developer, architect or Irish planning consultant, you should be aware that it is now industry standard to include daylight & sunlight reports as part of a planning application to local authorities or to An Bord Pleanála.

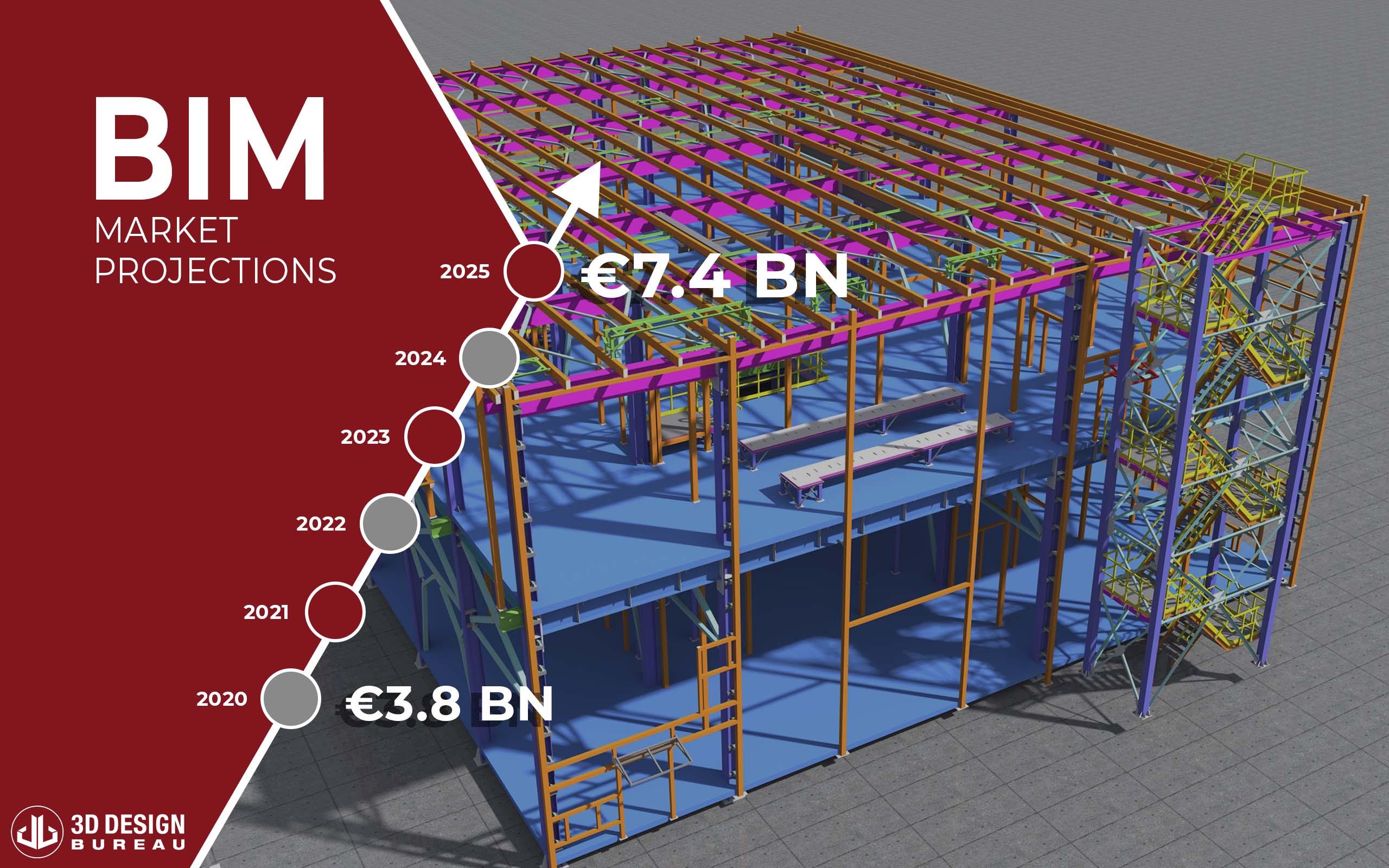

The future of the Building Information Modelling (BIM) market looks promising with major opportunities within the Architectural, Engineering and Construction (AEC) industry. According to a report by Market and Markets, The Global BIM Market is projected to grow from €3.78 billion in 2020 to €7.39 billion by 2025, with year-on-year growth of 14.5%.

Whilst BIM is not new, the recent growth of it has gathered pace in the past number of years. This is attributed to many factors, such as rapid urbanisation and demand for ‘green’ buildings, strong government support for making BIM mandatory, and using BIM for technologies such as AI, AR/VR, cloud, Big Data, and IoT. The market has also been accelerated due to the COVID-19 outbreak with focus shifting to find safer and smart ways of construction.

However, despite the savings that BIM can make to a project life cycle, a factor that is still restraining the market growth is the initial capital outlay of BIM.

BIM is an information exchange and collaborative process. BIM involves using a digital model at all stages of a project from concept right through to handover and facilities management. The ultimate goal of BIM is to have a digital twin of the ‘As Built’ project. The proper use of BIM throughout an entire project life-cycle results in significant value and return on that investment.

BIM is multi-dimensional and allows extra dimensions of data to be linked to a model. The common dimensions of BIM that have been developed are:

– 3D: Geometric Digital Modelling

– 4D: Project Scheduling

– 5D: Cost Analysis

– 6D: Sustainability – Daylight/sunlight, solar and wind analysis etc.

– 7D: Facilities Management – Of operational phase.

The dimensions apply to all roles within a project and can support decision-making in architecture (3D, 5D, 6D, 7D), quantity surveying (5D, 6D) and project management (3D, 4D, 5D).

Due to rising trends in digitisation across all industries, BIM is continuing to gain widespread adoption in the construction industry. Building applications mainly include commercial, residential, healthcare and retail buildings, however many infrastructure projects are also adopting BIM. Buildings are designed with BIM from the early concept design stage right through the construction phase and up to handover. The holy grail of BIM is to have a ‘digital twin’ of the finished development to be used for facilities management. (BIM Design Model – BIM Construction Model – BIM As a Built Model – BIM Facilities Management Model)

The combination of BIM and smart technologies such as artificial intelligence has also streamlined construction projects. Using big data and complex algorithms (Using AI) can create standardised design models at pace. The resulting digital models can then be tested on virtual platforms such as BIM 360 OPs to determine viability and cost, the local environment, and the developer’s specific requirements. This means decisions and commitments can be made at an early stage, which speeds up the whole process.

The COVID-19 pandemic forced the AEC sector to find safer and smarter ways of constructing buildings. During worldwide lockdowns, BIM facilitated the continuation of projects within the digital and virtual environment, even when participants were unable to meet in person. Whilst BIM has always been a collaborative process, this was accelerated due to COVID-19. BIM processes allowed data to be shared remotely across professional disciplines and facilitate smarter construction.

In the lead up to workers returning to construction sites, VR technology integrated with 3D BIM models has enabled off-site training of personal. Key workers such as managers and foremen have used VR headsets to improve their understanding of a project and changes to the running of a site. These immersive learning experiences have given employees the chance to get virtual hands-on and practical experience in a safe, risk-free environment while construction sites are closed.

Where work has recommenced on sites, the consensus is that a maximum of 60% of workers could safely return under social distancing rules. Emerging technologies such as GPS-enabled devices, that are integrated with 3D BIM models, are being adopted for workers. The software can be used as a valid surveillance and control system for construction sites and workplaces, with the aim of containing COVID-19 risk. This technology alerts individuals if they come too close to others, or accidentally mix with those outside their working bubble.

Nowadays, all public private partnership (PPP) tenders are requiring “some” form of BIM capability, although the standards and expectation vary from case to case. According to a report by Market and Markets, Asia-Pacific countries are likely to be the highest growing market for BIM in the coming years. In this region, BIM is being widely adopted for large-scale infrastructure and building projects. This is attributed to Government initiatives to construct ‘green’ buildings.

Governments in these regions have started imposing new regulations regarding building construction permits. Japan, China, and South Korea have already made BIM documents mandatory, especially for public buildings, along with green certification-related documents.

Other governments such as the UK and Ireland are trying to catch up with the private initiatives and encouraged by the Asia-Pacific governments. They have been putting in place roadmaps and plans that are starting to root in the industry.

For example, the UK recently concluded its Construction Strategy 2016-20, which meant that construction firms had to be BIM level 2 certified to work on government projects. During the next phase of the strategy, construction firms will need to work towards BIM Level 3 by 2025.

Ireland’s government will soon conclude the ‘Roadmap to the Digital Transition of Ireland’s Construction Industry 2018-2021’. This initiative introduced new BIM level 2 standards for public procurement for complex projects followed by medium and simple projects. The Irish government is increasingly setting a standard of BIM level 2 on PPP projects.

The building information modelling market is highly competitive owing to the presence of many small and large vendors providing solutions in the domestic and international market. According to Market and Markets, “The industry appears to be concentrated on moving towards the fragmented stage with the emergence of new players in the market. Major players in the market are adopting strategies like product & service innovation and mergers & acquisitions.”

Some of the key software players profiled in the Building Information Modelling Market include Archidata Inc, Asite Solutions, Autodesk Inc, Aveva Group Plc, Beck Technology Ltd, Bentley Systems, Cadsoft Corporation, Dassault Systèmes, Hexagon AB, Nemetschek SE, Pentagon Solution Ltd, RIB Software SE, Synchro Software Ltd, Tekla Corporation and Trimble Ltd.

A report by LetsBuild identified the top construction companies that are at the forefront of BIM technology and implementation. They include Hochtief Aktiengesellschaft, China Communications Construction Group, VINCI Bechtel Corporation, Skanska AB, Samsung C&T, Royal BAM Group, and Larsen & Toubro.

Large tech-companies such as Facebook, Google, and Malmo are increasingly relying on BIM to optimise their complex data centre projects. According to BIM consultancy group (DCT) Group, “Data centres need to be built and maintained differently as they involve new cooling techniques and denser server racks etc.”

The Building Information Modelling market is projected to witness tremendous growth by 2025. While 14.5% year-on-year growth is substantially higher than most industries, BIM demands could experience even higher grow caused by COVID-19.

Equally, government mandates for BIM certified buildings in the Asia-Pacific countries are expected to grow along with other regions such as the UK and Ireland are adopting a ‘green’ building approach.

Today’s uses of BIM in design are constantly evolving. As more technology enters the market and new use cases for BIM are being discovered, the potential for getting more out of digital models in the full construction lifecycle grows daily. The key to successful BIM projects is making sure all stakeholders in a project ‘buy in’ to the BIM process and understand it.

The only factor that is holding the widespread adoption of BIM back is the initial high costs to starting a project through this process.

Thank you for your message. It has been sent.